Maximize Your Earnings: Offshore Company Formation Insights

Maximize Your Earnings: Offshore Company Formation Insights

Blog Article

Everything You Required to Understand About Offshore Business Development

Browsing the complexities of offshore business formation can be a difficult task for several individuals and organizations looking to increase their procedures internationally. By unraveling the layers of advantages, difficulties, actions, tax obligation implications, and conformity commitments connected with overseas business formation, one can obtain a comprehensive insight right into this complex subject.

Benefits of Offshore Firm Development

The advantages of establishing an offshore company are complex and can substantially benefit individuals and organizations seeking critical monetary preparation. One vital benefit is the potential for tax optimization. Offshore companies are usually subject to desirable tax laws, permitting for minimized tax obligation obligations and boosted revenues. Additionally, establishing an overseas firm can give property protection by separating personal properties from business liabilities. This splitting up can secure personal wide range in case of legal disagreements or economic obstacles within business.

In addition, offshore business can facilitate worldwide organization operations by providing accessibility to international markets, diversifying profits streams, and boosting organization credibility on a global scale. By establishing an overseas existence, businesses can tap into brand-new possibilities for development and development past their residential borders.

Usual Difficulties Encountered

In spite of the countless benefits associated with overseas firm formation, businesses and people typically come across common difficulties that can influence their procedures and decision-making procedures. Browsing differing legal frameworks, tax obligation regulations, and reporting criteria throughout different territories can be overwhelming and taxing.

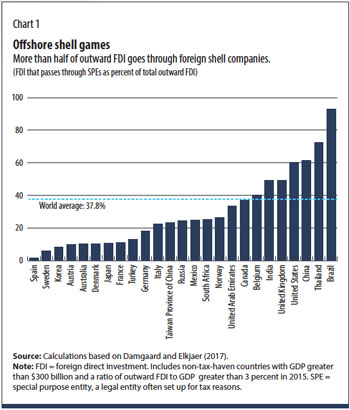

An additional common obstacle is the threat of reputational damages. Offshore companies are in some cases seen with uncertainty due to concerns concerning tax evasion, cash laundering, and lack of openness. Taking care of and mitigating these assumptions can be tough, especially in a significantly looked at global service atmosphere.

Moreover, establishing and keeping efficient communication and oversight with overseas procedures can be challenging because of geographical ranges, social distinctions, and time zone differences. This can result in misconceptions, hold-ups in decision-making, and troubles in monitoring the performance of overseas entities. Conquering these obstacles requires mindful planning, persistent threat monitoring, and a comprehensive understanding of the regulatory landscape in offshore territories.

Actions to Kind an Offshore Firm

Developing an offshore business includes a collection of calculated and lawfully compliant steps to guarantee a smooth and successful development procedure. The primary step is to select the offshore jurisdiction that ideal matches your organization demands. Aspects to think about include tax obligation guidelines, political security, and credibility. Next, you need to pick an ideal firm name and ensure it conforms with the laws of the picked territory. Following this, you will need to engage a signed up representative who will certainly help in the unification procedure. The fourth step entails preparing the required documentation, which generally includes write-ups of consolidation, shareholder info, and director details. Once the documents prepares, it needs to be sent to the pertinent authorities together with the requisite fees (offshore company formation). After the authorities accept the application and all charges are paid, the firm will certainly be formally registered. Ultimately, it is necessary to comply with recurring reporting and compliance demands to maintain the great standing of the overseas company.

Tax Implications and Considerations

Purposefully navigating tax ramifications is critical when forming an offshore business. One of the primary reasons individuals or companies select overseas firm development is to profit from tax obligation advantages. It is essential to understand and comply with both the tax important link obligation regulations of the overseas jurisdiction and those of the home country to ensure lawful tax obligation optimization.

Offshore firms are usually based on positive tax regimes, such as reduced or absolutely no company tax obligation rates, exemptions on particular types of income, or tax obligation deferral options. While these benefits can lead to considerable savings, it is vital to structure the offshore firm in a means that lines up with tax obligation regulations to stay clear of possible legal issues.

In addition, it is essential to think about the ramifications of Controlled Foreign Firm (CFC) regulations, Transfer Prices policies, and various other worldwide tax obligation laws that might affect the tax obligation treatment of an overseas business. Seeking suggestions from tax specialists or experts with know-how in offshore taxation can assist navigate these complexities and make certain conformity with relevant tax obligation guidelines.

Taking Care Of Compliance and Laws

Browsing via the elaborate web of conformity needs and policies is crucial for guaranteeing the smooth procedure of an offshore business, specifically because of tax obligation effects and considerations. Offshore territories frequently have certain regulations governing the formation and procedure of companies to stop cash laundering, tax evasion, and other illegal tasks. It is crucial for companies to remain abreast of these regulations to avoid large fines, legal problems, or also the opportunity of being shut down.

To handle conformity effectively, offshore business must assign knowledgeable experts that understand the global criteria and neighborhood regulations. These professionals can assist in developing appropriate administration frameworks, preserving precise monetary records, and sending called for records to governing authorities. Regular audits and testimonials need to be carried out to guarantee recurring compliance with all appropriate laws and regulations.

In addition, staying educated regarding modifications in regulations and adapting techniques appropriately is important for long-term success. Failing to abide by guidelines can tarnish the track record of the firm and bring about serious consequences, highlighting the importance of focusing on compliance within the offshore firm's operational structure.

Final Thought

Finally, overseas business formation provides different advantages, however likewise includes difficulties such as tax ramifications and conformity demands - offshore company formation. By complying with the required steps and considering all elements of forming an overseas company, organizations can benefit from global possibilities check while handling dangers effectively. It is essential to stay notified about regulations and remain certified to make certain the success and durability of the offshore organization endeavor

By deciphering the layers of advantages, difficulties, actions, tax effects, and compliance commitments associated with overseas company development, one can gain a detailed understanding into this complex subject.

Offshore firms are typically subject to desirable tax regulations, permitting for reduced tax obligation liabilities and boosted earnings. One of the main reasons people or organizations choose for overseas firm formation is to profit Full Report from tax advantages. Offshore territories frequently have certain laws regulating the formation and operation of business to protect against money laundering, tax evasion, and various other immoral activities.In verdict, overseas company formation uses various advantages, yet additionally comes with challenges such as tax ramifications and conformity needs.

Report this page